First-Time Homebuyer Mistakes Kissimmee FL | Expert Tips to Save Thousands

💡 10 Costly Mistakes First-Time Homebuyers Make in Kissimmee — And How to Avoid Them

✨ Buying Your First Home in Kissimmee Should Be Exciting — Not Stressful

For many first-time buyers, Kissimmee is the dream — a vibrant city with proximity to Orlando, a thriving community, and homes that still offer great value compared to surrounding areas.

But here’s the truth: buying your first home without the right guidance can be expensive. Small mistakes can cost you thousands of dollars, delay your closing, or even cost you the home you love.

I’ve compiled this list of the 10 most common mistakes I see first-time buyers make in Kissimmee — and the exact steps to avoid them.

❌ Mistake #1: Skipping Pre-Approval

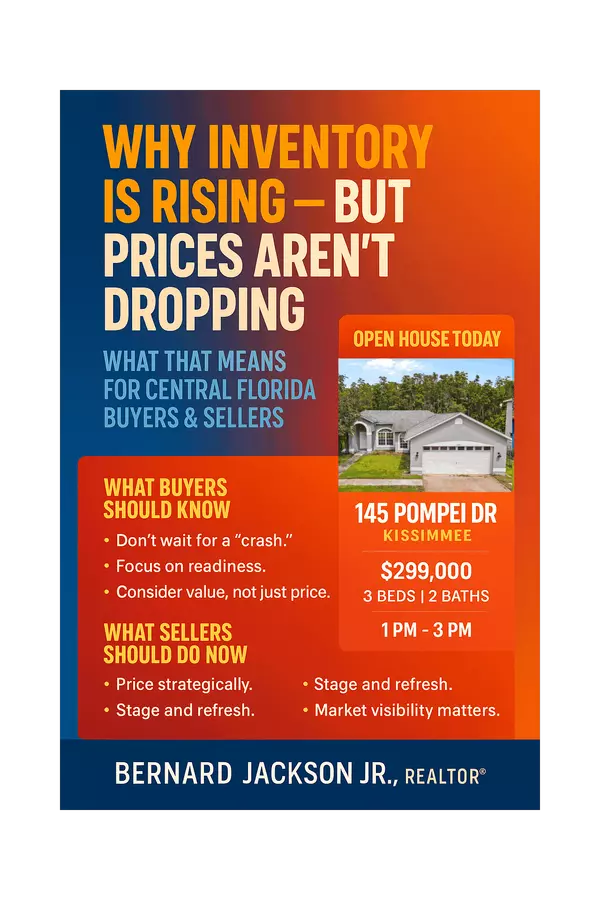

Without pre-approval, sellers won’t take your offer seriously. In Kissimmee’s competitive market, homes under $350K can sell in days — and you’ll lose valuable time if you’re not ready to make an offer.

The Fix: Get pre-approved before you even start looking. This tells you exactly what you can afford and positions you as a serious buyer.

❌ Mistake #2: Falling in Love With the Wrong Home

It’s easy to be swept away by granite countertops and big backyards — but if it’s outside your budget or in the wrong neighborhood, it’s not the right fit.

The Fix: Make a must-have list and stick to it. Remember: location and affordability come before upgrades.

❌ Mistake #3: Draining Your Savings for the Down Payment

Many first-time buyers empty their bank accounts to cover the down payment — leaving nothing for emergencies.

The Fix: Use programs like Florida Hometown Heroes, which can cover up to $35,000 in down payment and closing costs.

❌ Mistake #4: Skipping the Inspection

An inspection might cost $400–$500, but it can save you from buying a home with hidden issues.

The Fix: Always hire a licensed home inspector and attend the inspection so you can ask questions.

❌ Mistake #5: Ignoring HOA Rules

Kissimmee has many communities with HOAs. Rules about parking, pets, and rentals could impact your lifestyle or plans.

The Fix: Read the HOA documents before you close — not after.

❌ Mistake #6: Forgetting About Closing Costs

Closing costs in Florida average 2–5% of the home price. Many buyers overlook these expenses until the last minute.

The Fix: Ask your Realtor to request seller credits or builder incentives to help cover them.

❌ Mistake #7: Underestimating Monthly Expenses

Your mortgage isn’t your only expense — you’ll have property taxes, insurance, utilities, and maintenance.

The Fix: Get a full breakdown of all costs from your lender before making an offer.

❌ Mistake #8: Making Big Purchases Before Closing

Buying furniture, a car, or opening new credit cards can hurt your credit score or debt-to-income ratio — and tank your mortgage approval.

The Fix: Wait until after closing to make big purchases.

❌ Mistake #9: Moving Too Slowly

In Kissimmee’s market, hesitation can cost you the home you love.

The Fix: Be ready to view homes quickly and make strong offers when you find the right one.

❌ Mistake #10: Thinking You Can’t Afford It

Many renters in Kissimmee could own for the same or less than they pay in rent — they just don’t realize it.

The Fix: Talk to a Realtor who can show you the numbers and connect you with the right lender.

📜 The Kissimmee First-Time Buyer Success Blueprint

-

Get pre-approved

-

Explore assistance programs

-

Make your must-have list

-

Tour homes with a local expert

-

Act quickly when you find “the one”

🏆 Local Client Story: Avoiding a $7,500 Mistake

Maria and Luis were excited to buy their first home in Kissimmee. They skipped pre-approval and fell in love with a home — only to lose it to another buyer.

When they came to me, we:

-

Got them pre-approved in 48 hours

-

Found a better home in their ideal neighborhood

-

Negotiated $7,500 in seller credits for closing costs

❓ FAQs

Q1: How much do I need for a down payment in Kissimmee?

A: With assistance programs, as little as $0–$2,000.

Q2: How long does it take to close?

A: Typically 30–45 days after your offer is accepted.

Q3: What credit score do I need?

A: Many programs start at 580.

Q4: Are there special programs for first responders or teachers?

A: Yes — Florida Hometown Heroes offers benefits for eligible professions.

Q5: Should I buy new construction or resale?

A: It depends on your priorities. New construction offers warranties and energy efficiency; resale may offer lower prices and established neighborhoods.

🧾 About Bernard Jackson

I’m Bernard Jackson Jr., a bilingual REALTOR® with LPT Realty, serving Kissimmee, Poinciana, Davenport, and surrounding areas since 2015. I specialize in helping first-time buyers navigate the process with confidence, ensuring you avoid costly mistakes and make informed decisions.

📞 Call/Text: (321) 443-5582

📧 Email: bernardjacksonrealtor@gmail.com

🌐 Website: BernardSellsFLHomes.com

🚀 Take the First Step

Avoid costly mistakes and start your Kissimmee homeownership journey today.

👉 Schedule Your Free Buyer Consultation

Categories

- All Blogs (194)

- #FearlessFriday (10)

- #MotivationalMonday (14)

- #solutionsaturday (6)

- #SoulfulSunday (7)

- #TechnologyThursday (10)

- #WellnessWednesday (14)

- 10 Steps To Know About Buying A Home In Poinciana (1)

- 10 Things To Know About Davenport (1)

- 10 Things To Know About Poinciana (1)

- 5 New Things For Poinciana For 2025 (1)

- Annual Events and Festivals in Kissimmee, Fl (2)

- Benefits of Living in Poinciana (1)

- Benefits of Selling to a Cash Buyer (1)

- Buyers (74)

- City Guides Kissimmee (13)

- CITY GUIDES: Poinciana Real Estate News & Resources (3)

- CITY STATISTICS: Davenport Real Estate News & Resources (1)

- City Statistics: Kissimmee (2)

- CITY STATISTICS: Lake Wales Real Estate News & Resources (1)

- Kissimmee Homes For Rent (4)

- Kissimmee Homes For Sale (9)

- Pros and Cons of Living in Kissimmee, FL (1)

- Renters (37)

- Retirement In Poinciana, FL (1)

- Sellers (16)

- Things To Do In Poinciana (2)

- Things To Do Near Kissimmee, FL (2)

- Things To Do NYE 2025 In Orlando and Kissimmee, FL (1)

- Truth About 20 Percent Down (1)

- What Are The Benefits of Living In Kissimmee (1)

- Your Dream House (1)

Recent Posts

![Top Neighborhoods to Buy in Kissimmee, FL [2025 Edition]](https://cdn.lofty.com/image/fs/508869918698733/website/69580/cmsbuild/w600_20251015_bd7c9ded26d940d4-png.webp)

GET MORE INFORMATION