Why Wait Can Be Costly?

Why Waiting for Lower Interest Rates Could Cost You a Fortune in Homeownership

Something to think about (it's long but stay with me)...

In 1978, the average interest rate was 7.33%. If you were waiting for rates to drop before buying a home, you wouldn’t have purchased until 1993, when rates finally dipped below 7%. That means you would have waited 22 years to buy a home.

Here’s what that means in real dollars and opportunities lost:

- On average, after 22 years, most homeowners have about 50% equity in their homes.

- Historically, homes in the U.S. appreciate between 88% and 110% over 22 years, assuming a conservative annual appreciation rate of 4%.

- If you rented instead, your landlord gained all that equity and appreciation while you walked away with nothing to show for it.

🏡 So what’s the lesson here? Waiting can be FAR more expensive than buying.

💭 The Myth of the "Perfect Time" to Buy a Home

A lot of renters fall into the trap of thinking:

❌ "Interest rates are too high right now."

❌ "I’ll wait for the market to crash."

❌ "I’ll buy when I have a bigger down payment."

Sounds logical, right? But here’s the reality: There is no perfect time. The best time to buy is when you’re financially ready.

Even at today’s rates, waiting could mean:

👉 Higher home prices – Home values historically rise over time. If you wait, you’ll pay more later.

👉 Lost equity – If you buy now, your home is already appreciating while you build equity.

👉 More money wasted on rent – Every rent check builds someone else’s wealth, not yours.

📉 Interest Rates vs. Home Appreciation: Which Costs More?

Let’s break this down:

If you buy a $300,000 home today with a 7% interest rate, your mortgage payment might be higher than you’d like. But let’s compare that to the cost of waiting:

🔹 If home prices rise 4% annually, in 5 years that same home could cost $365,000.

🔹 Even if rates dropped to 5%, your payment wouldn’t decrease as much as the new home price would increase.

🔹 You’d also miss out on thousands of dollars in equity growth.

🏡 Key takeaway: You can refinance a mortgage, but you can’t rewind time and buy at yesterday’s prices.

💡 Why Renting Costs More Than You Think

Renting may feel like the safer option, but let’s put it in perspective:

🔸 Renting for 22 years at $2,000/month = $528,000 spent on rent.

🔸 At the end of those 22 years, you own nothing.

🔸 Meanwhile, a homeowner could have built hundreds of thousands in equity.

📈 When you rent, you’re making someone else rich. When you own, you’re building your own future.

🔑 The Fastest Path to Homeownership (Even If You Think You’re Not Ready)

Not sure if you’re ready? Here’s how to make homeownership a reality sooner than you think:

✅ Check Down Payment Assistance Programs – You may qualify for grants or low down payment options. Find out here.

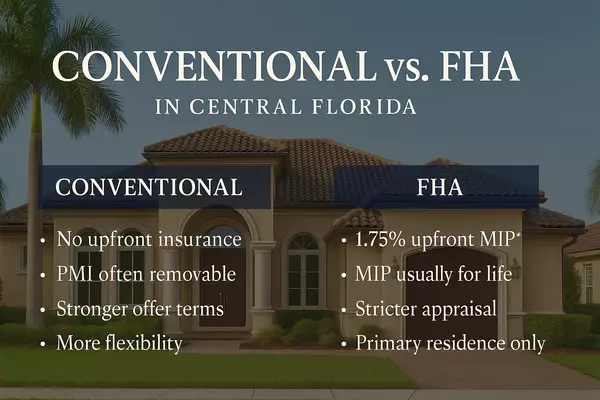

✅ Understand Your Loan Options – FHA loans allow credit scores as low as 580 with just 3.5% down.

✅ Work with a Knowledgeable REALTOR® – Navigating the market alone is tough. I’m here to help you strategize and find the best deal.

📢 Your dream home might be closer than you think! Let’s talk about your options.

🚀 What’s Next? Take Action Now!

The worst mistake you can make is doing nothing. Waiting for the “perfect” time could mean missing out on thousands of dollars in equity and locking yourself into a lifetime of renting.

🔹 Step 1: Read the full guide 👉 6 Things to Know About Buying a Home

🔹 Step 2: Browse homes 👉 Kissimmee Homes for Sale

🔹 Step 3: See homes under $500K 👉 Affordable Kissimmee Homes

🔹 Step 4: Get pre-approved! DM me or call 321.443.5582 to start your journey.

🏡 Don't wait. Let's turn your dream into reality.

📩 Got questions? Let’s talk! DM me, call 321.443.5582, or visit bernardsellsflhomes.com to start your journey today!

About the Bernard Jackson

Bernard Jackson is a dedicated and highly regarded REALTOR® serving the Central Florida real estate market. With a strong presence in Kissimmee, Davenport, Winter Haven, and Haines City, Bernard is known for his deep market knowledge, strong negotiation skills, and unwavering commitment to his clients.

Clients consistently praise Bernard for his attentiveness, responsiveness, and ability to secure the best deals—whether they’re buying their first home, upgrading, or selling a property. His personalized approach ensures that every client’s unique needs and goals are met with expert guidance and care.

Bernard's reputation is built on trust, professionalism, and a results-driven mindset, making him a top choice for homebuyers and sellers in the area. His 5-star reviews highlight his ability to navigate the complexities of real estate with ease, providing a smooth and stress-free experience.

To learn more about Bernard Jackson and read client testimonials, visit:

📍 Google Business Profile – Search "Bernard Jackson Realtor"

📍 Realtor.com – Find client reviews and real estate insights

📍 LinkedIn – Connect with Bernard for additional insights

For expert real estate guidance, contact Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com/contact

Categories

- All Blogs (184)

- #FearlessFriday (10)

- #MotivationalMonday (14)

- #solutionsaturday (6)

- #SoulfulSunday (7)

- #TechnologyThursday (10)

- #WellnessWednesday (14)

- 10 Steps To Know About Buying A Home In Poinciana (1)

- 10 Things To Know About Davenport (1)

- 10 Things To Know About Poinciana (1)

- 5 New Things For Poinciana For 2025 (1)

- Annual Events and Festivals in Kissimmee, Fl (2)

- Benefits of Living in Poinciana (1)

- Benefits of Selling to a Cash Buyer (1)

- Buyers (73)

- City Guides Kissimmee (4)

- CITY GUIDES: Poinciana Real Estate News & Resources (3)

- CITY STATISTICS: Davenport Real Estate News & Resources (1)

- City Statistics: Kissimmee (2)

- CITY STATISTICS: Lake Wales Real Estate News & Resources (1)

- Kissimmee Homes For Rent (4)

- Kissimmee Homes For Sale (9)

- Pros and Cons of Living in Kissimmee, FL (1)

- Renters (37)

- Retirement In Poinciana, FL (1)

- Sellers (16)

- Things To Do In Poinciana (2)

- Things To Do Near Kissimmee, FL (2)

- Things To Do NYE 2025 In Orlando and Kissimmee, FL (1)

- Truth About 20 Percent Down (1)

- What Are The Benefits of Living In Kissimmee (1)

- Your Dream House (1)

Recent Posts

GET MORE INFORMATION