Avoiding Mortgage Denial

Avoiding Mortgage Denial: How to Tackle Debt-to-Income Challenges this Holiday Season

The holidays are a time for joy, reflection, and planning for the future. For many, this includes taking the first steps toward homeownership. However, one financial metric—your debt-to-income (DTI) ratio—can turn your dream into a temporary setback. With some strategic planning and guidance, you can avoid common pitfalls and position yourself for mortgage approval.

What is Debt-to-Income Ratio (DTI), and Why Does it Matter?

DTI is a measure of your financial health that compares your monthly debt obligations to your gross income. Lenders rely heavily on this ratio to determine how much additional debt you can handle. For example:

- Front-End DTI focuses on housing expenses (rent or mortgage payments, property taxes, insurance).

- Back-End DTI includes all monthly debts, such as credit cards, student loans, car payments, and child support.

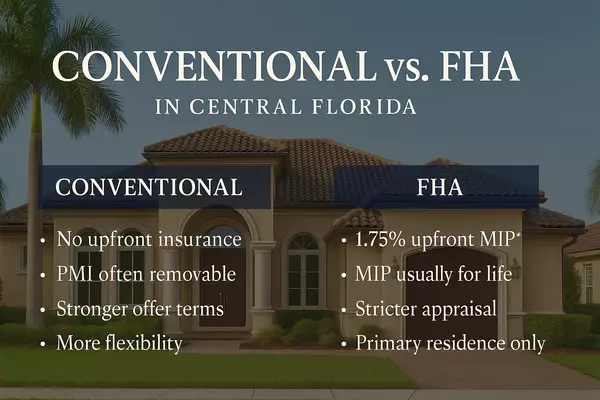

Most conventional lenders prefer a DTI below 36%. However, certain programs, like FHA loans, allow for ratios as high as 50% under specific conditions

Holiday Spending: A Double-Edged Sword

The holidays often bring joy but can also inflate your debt. Between gift-giving, travel, and seasonal celebrations, many buyers unintentionally raise their DTI, which could harm their mortgage application. For example:

- Adding $5,000 of holiday credit card debt increases your monthly payments and pushes your DTI higher.

- Delayed payments or overspending can also affect your credit score, another critical factor in loan approval.

How High DTI Leads to Mortgage Denials

- Risk to Lenders: High DTIs indicate you’re over-leveraged, which increases the risk of missed payments.

- Lower Loan Approval Amounts: Even if approved, you may qualify for less financing, limiting your home options.

- Stricter Underwriting: Loans such as conventional mortgages have rigid DTI caps. If you’re over the limit, the application may be denied

Steps to Improve Your DTI Ratio

1. Audit and Adjust Spending

Start by listing your monthly income and all debts. Use tools like spreadsheets or budgeting apps to identify areas where you can cut back.

2. Tackle High-Interest Debt First

Focus on reducing debts with the highest interest rates, such as credit cards. This approach reduces your overall monthly obligations.

3. Explore Refinancing or Loan Consolidation

Consider consolidating multiple loans into one with a lower monthly payment. For homeowners, cash-out refinancing can also be a strategic option

4. Increase Your Income

Temporary side gigs during the holidays can provide extra cash flow, helping reduce your debts and improve your financial standing.

5. Avoid New Debt

Delay large purchases, such as furniture or cars, until after your mortgage closes. New debt increases your DTI and could jeopardize loan approval.

Why This Matters Now: Timing is Everything

The new year often brings changes in interest rates and lending policies. By taking control of your DTI today, you position yourself to capitalize on the current market conditions. Waiting could mean higher monthly payments or stricter lending requirements.

Let’s Talk About Your Homeownership Goals

Ready to take the first step? Let’s make the holiday season even brighter with a plan tailored to your buying or selling needs. I’d love to invite you for a cup of coffee to discuss how we can make your real estate dreams a reality.

Let's grab coffee on me,

📅 Schedule Your Free Consultation:

Click Here to Book a Meeting with Me

About Bernard Jackson

As your dedicated REALTOR®️ at LPT Realty, I bring a wealth of expertise in Florida’s real estate market. Whether you’re a first-time buyer or a seasoned homeowner, I’ll guide you every step of the way.

📱 Contact Information:

Bernard Jackson | REALTOR®️ | LPT Realty

📞 321.443.5582

🌐 www.bernardsellsflhomes.com

Take Action Now

The perfect home is waiting, and the time to act is now. Don’t let financial hurdles stand in your way. Together, we can make your real estate dreams come true!

Sources:

- CNBC on DTI and mortgage denials

- Insights on financial readiness from NerdWallet

Categories

- All Blogs (184)

- #FearlessFriday (10)

- #MotivationalMonday (14)

- #solutionsaturday (6)

- #SoulfulSunday (7)

- #TechnologyThursday (10)

- #WellnessWednesday (14)

- 10 Steps To Know About Buying A Home In Poinciana (1)

- 10 Things To Know About Davenport (1)

- 10 Things To Know About Poinciana (1)

- 5 New Things For Poinciana For 2025 (1)

- Annual Events and Festivals in Kissimmee, Fl (2)

- Benefits of Living in Poinciana (1)

- Benefits of Selling to a Cash Buyer (1)

- Buyers (73)

- City Guides Kissimmee (4)

- CITY GUIDES: Poinciana Real Estate News & Resources (3)

- CITY STATISTICS: Davenport Real Estate News & Resources (1)

- City Statistics: Kissimmee (2)

- CITY STATISTICS: Lake Wales Real Estate News & Resources (1)

- Kissimmee Homes For Rent (4)

- Kissimmee Homes For Sale (9)

- Pros and Cons of Living in Kissimmee, FL (1)

- Renters (37)

- Retirement In Poinciana, FL (1)

- Sellers (16)

- Things To Do In Poinciana (2)

- Things To Do Near Kissimmee, FL (2)

- Things To Do NYE 2025 In Orlando and Kissimmee, FL (1)

- Truth About 20 Percent Down (1)

- What Are The Benefits of Living In Kissimmee (1)

- Your Dream House (1)

Recent Posts

GET MORE INFORMATION