Florida Real Estate Update 2025: Rates Easing, Insurance Shifts & Inventory

Florida & U.S. Real Estate Right Now: Rates Easing, Insurance Reset, More Inventory—Here’s How to Play It

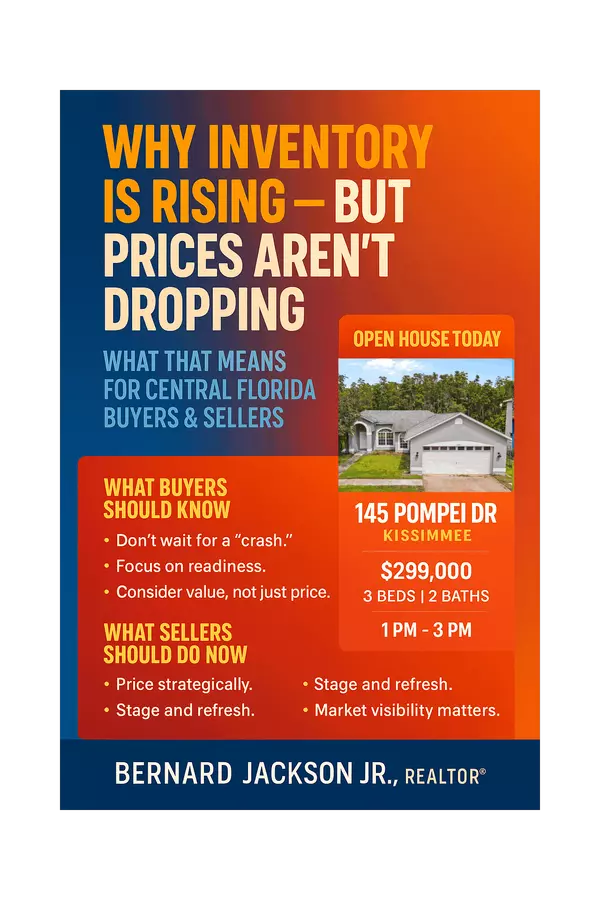

Across the housing conversation this month, a few themes keep bubbling up: the glide lower in mortgage rates from 2024 highs; a meaningful rise in canceled contracts as buyers regain leverage; Florida’s insurance market rapidly shifting as the state-backed insurer sheds policies; and tighter condo-governance rules that make financials clearer (and sometimes dues higher). If you’re renting—or you’re a homeowner thinking about timing—this is your moment to get strategic.

Below, I translate the noise into a clear plan for buyers, sellers, and investors in Poinciana (34758–34759), Kissimmee, and Davenport—with actionable steps, local nuance, and resources to move from browsing to closing in ~90 days.

1) Rates & Affordability Pulse

Mortgage rates have eased compared to last year’s peaks. Mid-September data show the average 30-year fixed falling into the mid-6s, the lowest since late 2024, and refi activity jumping—classic signs that rate relief is trickling through the system.

What this means for you: every 0.25% drop trims roughly $60–$70 per month on a $400,000 loan, putting homeownership back within reach for many renters—especially when combined with credits and buydowns (more on that shortly).

Remember: daily rate moves don’t always match central bank headlines one-for-one. Long-term mortgage pricing hugs the 10-year Treasury, inflation expectations, and risk appetite. Translation: be ready to lock opportunistically when pricing aligns with your payment target.

2) Why More Deals Are Falling Through (And How to Use It)

Another big theme in recent chatter: contract cancellations are elevated, with inspection issues, costs, and shifting leverage giving buyers confidence to walk away. If you’re prepared, that leverage becomes your advantage: repairs, credits, closing-cost help, or rate buydowns.

On the ground, I’m seeing a “quality premium”: well-prepared buyers who write clean offers (but keep smart protections) often secure better terms than those trying to win with price alone. Pair that with a pre-approval and a clear inspection strategy, and you’ll out-negotiate most of the field.

3) Florida Insurance: From Crisis to Reset

Here’s the refresh everyone’s watching: Florida’s state-backed insurer, Citizens, has been reducing its policy count through depopulation as private carriers step back in. For many owners, it’s translating into more private options and, in select geographies, more competitive premiums versus a year ago.

Context matters: Florida still ranks among the most expensive states for homeowners insurance, and non-renewals remain a risk, but the direction of travel—policy count, exposure, and carrier participation—has improved meaningfully in 2025. Shop early, compare options, and pursue mitigation credits (roof, water-leak sensors, wind protection) to maximize savings.

Want a second opinion on your coverage before you list or buy? I can connect you with vetted local pros during your inspection window.

4) Condo & Co-Op: New Rules, Clearer Books

Recent Florida legislation tightened inspections, reserves, records, and governance across associations. Practically, buyers now see clearer budgets and reserve plans; some communities will raise dues to ensure long-term safety. Sellers benefit from transparency when their associations are well-run. Always review the reserve study, milestone reports, insurance, and special-assessment history before you go under contract.

5) Tactics That Win Right Now

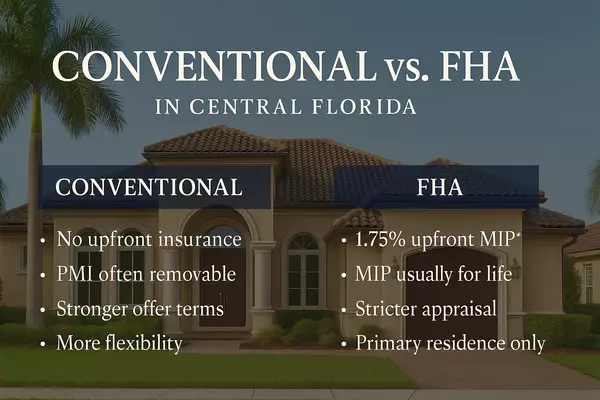

i) Assumable Low-Rate Loans (When Available)

One affordability unlock dominating buyer conversations is the search for assumable FHA/VA/USDA loans. When the numbers pencil, you take over the seller’s low rate and pay/finance the equity gap. It isn’t “easy,” but when it works, the monthly savings are real.

ii) Temporary Buydowns & Seller Credits

With cancellations up and inventory more negotiable, buyers are again asking for 2-1/1-0 buydowns or closing-cost credits. These can pair with lender-paid options to hit your payment target while you wait for further rate relief (no guarantees).

iii) House-Hacking & Co-Buy Structures

For renters trying to cross the bridge into ownership, house-hacking remains a powerful strategy: live in one part, rent the other, reduce your payment, and build equity. Co-buy agreements—with clear legal frameworks—are also gaining traction among friends and family who want to split down payments and carry costs responsibly.

iv) Investor Lens: DSCR Loans & STR Discipline

Investors are leaning on DSCR products where rent-to-payment math qualifies the deal. In 2025, that comes with tighter underwriting, higher reserves, and a premium for truly resilient markets (insurance, taxes, and regulation considered). For short-term rentals, standout design and strong ops matter more than ever.

v) Listing Strategy: Repairs, Rate Tools, and Transparency

Sellers are winning by pre-inspecting, addressing high-impact items, offering transparent documentation (roof, 4-point, wind-mit), and using rate tools (temporary buydowns) to widen the buyer pool without blunt price cuts. In Florida, clean insurance files and mitigation features can be the difference between an offer and a pass.

6) Local Snapshots: Poinciana • Kissimmee • Davenport

Poinciana (34758–34759): Excellent target for first-time buyers and budget-minded move-ups. Inventory is more varied than last year; negotiate for repairs/credits. Monitor HOA/insurance requirements early in the process.

Kissimmee: Mix of primary homes and investor interest. Location and commute still drive premiums. Insurance line items and inspection outcomes strongly influence loan approvals; tighten your contract timelines.

Davenport: New-construction and STR-adjacent options provide flexibility; consider builder incentives vs. resale credits. For STRs, underwrite conservatively (seasonality, true cleaning/ops costs, and insurance). Recent cancellation trends suggest buyers will walk if the math misses—so price with precision.

| Role | Your Next Best Move |

|---|---|

| Renters → Owners | Lock a pre-approval, target homes that qualify for credits/buydowns, and be open to house-hacking or co-buy structures. Use our 90-day roadmap to compress timelines. |

| Sellers | Pre-inspect, fix safety/insurance items, prep docs (roof, 4-point, wind-mit), and offer a rate buydown option to widen your buyer pool. |

| Investors | Model DSCR with realistic rents, full insurance/tax loads, and exit timelines. Focus on durable submarkets and asset quality over headline cap rates. |

8) Quick FAQs

- “Should I wait for rates to drop more?”

- Timing the bottom is hard. Use a payment target: if we can structure credits/buydowns to hit your monthly comfort zone on a home you love, you win now—and can always refinance if the math improves.

- “Is insurance really improving in Florida?”

- Premiums remain elevated vs. the U.S., but the market is normalizing at the margins. Citizens policy count and exposure are down; private carriers are writing more. Your address, roof, mitigation, and carrier appetite still drive outcomes.

- “What about condo buildings?”

- Expect stricter reserves and inspection compliance. That’s good for long-term value and safety but can mean higher dues—so underwrite the HOA like a business.

- “Are cancellations a red flag?”

- They’re a sign buyers have options and are protecting themselves after inspections. Use it: ask for repairs, credits, or a rate buydown to hit your payment goal.

9) Your Next Steps (Start Today)

- Get Pre-Approved: Know your exact budget and rate options—including temporary buydowns. Apply here.

- Download the 90-Day Roadmap: Become a Home Owner in 90 Days.

- Book a Free Strategy Call: We’ll align budget, neighborhoods, and negotiation levers. Pick a time.

- Tour smart: Target homes likely to qualify for seller credits, clean inspections, or loan assumptions.

- Negotiate precisely: Use inspection data, insurance quotes, and buydowns to hit your payment target.

Categories

- All Blogs (192)

- #FearlessFriday (10)

- #MotivationalMonday (14)

- #solutionsaturday (6)

- #SoulfulSunday (7)

- #TechnologyThursday (10)

- #WellnessWednesday (14)

- 10 Steps To Know About Buying A Home In Poinciana (1)

- 10 Things To Know About Davenport (1)

- 10 Things To Know About Poinciana (1)

- 5 New Things For Poinciana For 2025 (1)

- Annual Events and Festivals in Kissimmee, Fl (2)

- Benefits of Living in Poinciana (1)

- Benefits of Selling to a Cash Buyer (1)

- Buyers (74)

- City Guides Kissimmee (11)

- CITY GUIDES: Poinciana Real Estate News & Resources (3)

- CITY STATISTICS: Davenport Real Estate News & Resources (1)

- City Statistics: Kissimmee (2)

- CITY STATISTICS: Lake Wales Real Estate News & Resources (1)

- Kissimmee Homes For Rent (4)

- Kissimmee Homes For Sale (9)

- Pros and Cons of Living in Kissimmee, FL (1)

- Renters (37)

- Retirement In Poinciana, FL (1)

- Sellers (16)

- Things To Do In Poinciana (2)

- Things To Do Near Kissimmee, FL (2)

- Things To Do NYE 2025 In Orlando and Kissimmee, FL (1)

- Truth About 20 Percent Down (1)

- What Are The Benefits of Living In Kissimmee (1)

- Your Dream House (1)

Recent Posts

![Top Neighborhoods to Buy in Kissimmee, FL [2025 Edition]](https://cdn.lofty.com/image/fs/508869918698733/website/69580/cmsbuild/w600_20251015_bd7c9ded26d940d4-png.webp)

GET MORE INFORMATION

7) What Today’s Housing Conversation Is Signaling

Across public forums and feeds, affordability hacks dominate the discussion—assumptions, credits, and house-hacking—alongside practical worry about insurance lines and condo reserves. Buyers want payment stability and clarity; sellers who provide both are still winning. Meanwhile, investors are re-risking with better underwriting and tighter debt terms.

It’s not “doom.” It’s discipline. The signal behind the noise: transparent numbers, clean properties, and flexible deal structures are selling in 2025.