10 Things To Know To Become a Homeowner

10 Things To Know To Become a Homeowner in 2025: A Florida REALTOR’s Easy Guide

Becoming a homeowner is a big dream for many people, and 2025 is a great time to make it happen! But buying a home can feel overwhelming, especially with all the changes happening in the real estate market. Don’t worry—I’m here to help! As a Florida REALTOR®, I’ve put together this simple guide to walk you through the 10 most important things you need to know to become a homeowner in 2025. Let’s get started!

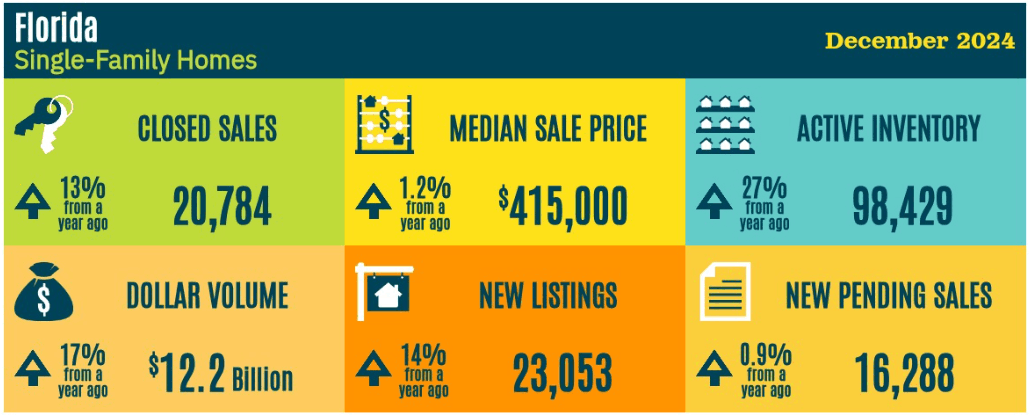

1. Learn About the 2025 Housing Market

The housing market is always changing, and 2025 will be no different. Here’s what you can expect:

-

Home Prices: In Florida, home prices are expected to grow slowly, which is good news for buyers. However, popular areas like Miami, Orlando, and Tampa might still be competitive.

-

More Homes for Sale: Builders are working hard to create new homes, so there will be more options to choose from.

-

Suburban Living is Hot: Many people are moving to the suburbs for more space and quieter neighborhoods, especially since remote work is still popular.

Understanding these trends can help you decide when and where to buy. For example, if you’re looking for a quieter lifestyle, suburban areas might be perfect for you. And with more homes hitting the market, you’ll have a better chance of finding one you love.

Ready to start your home search? Contact Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com to get expert advice tailored to your needs!

2. Get Your Money Ready

Before you start looking at homes, you need to make sure your finances are in good shape. Here’s how:

-

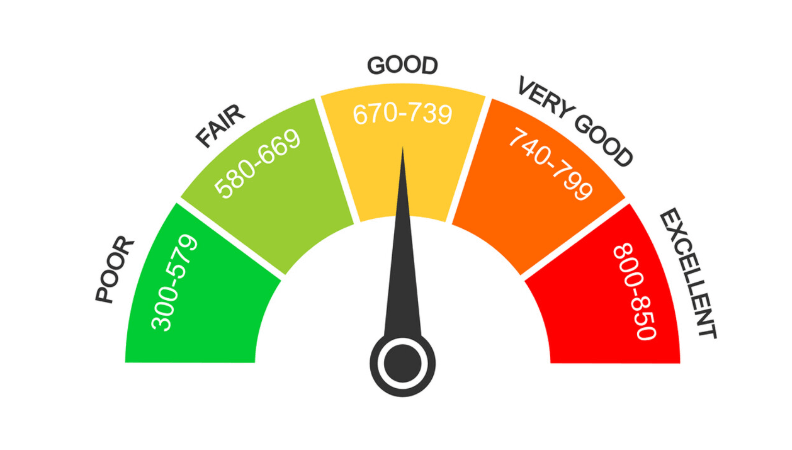

Check Your Credit Score: A good credit score (740 or higher) will help you get the best mortgage rates. You can check your score for free online through websites like Credit Karma or your bank’s website.

-

Save for a Down Payment: Most people aim to save 20% of the home’s price, but there are programs that let you buy with less. For example, Florida offers first-time homebuyer programs that can help with down payments and closing costs.

-

Plan for Closing Costs: These are extra fees you pay when you buy a home, usually 2% to 5% of the price. Make sure to budget for these so you’re not surprised later.

-

Pay Off Debt: Lenders will look at how much debt you have compared to your income, so try to pay off credit cards or loans. This will make it easier to qualify for a mortgage.

Getting your finances in order early is one of the most important steps to becoming a homeowner. If you’re not sure where to start, reach out to Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com for personalized financial guidance.

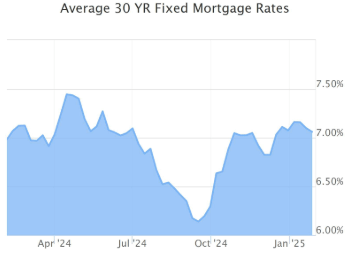

3. Watch Mortgage Rates

Mortgage rates are super important because they affect how much you’ll pay each month. Here’s what to know:

-

Rates Might Stay Stable: Experts think rates will level out in 2025, but it’s still smart to keep an eye on them. Even a small change in rates can make a big difference in your monthly payment.

-

Compare Lenders: Different lenders offer different rates, so shop around to find the best deal. Don’t be afraid to ask questions or negotiate.

-

Fixed vs. Adjustable Rates: A fixed-rate mortgage stays the same for the life of the loan, while an adjustable-rate mortgage (ARM) can change over time. Fixed rates are usually safer, but ARMs might start lower.

When you’re ready to buy, make sure to lock in your rate so it doesn’t go up while you’re closing on your home. This is a key step that many first-time buyers forget!

Need help finding the best mortgage rates? Call Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com to connect with trusted lenders.

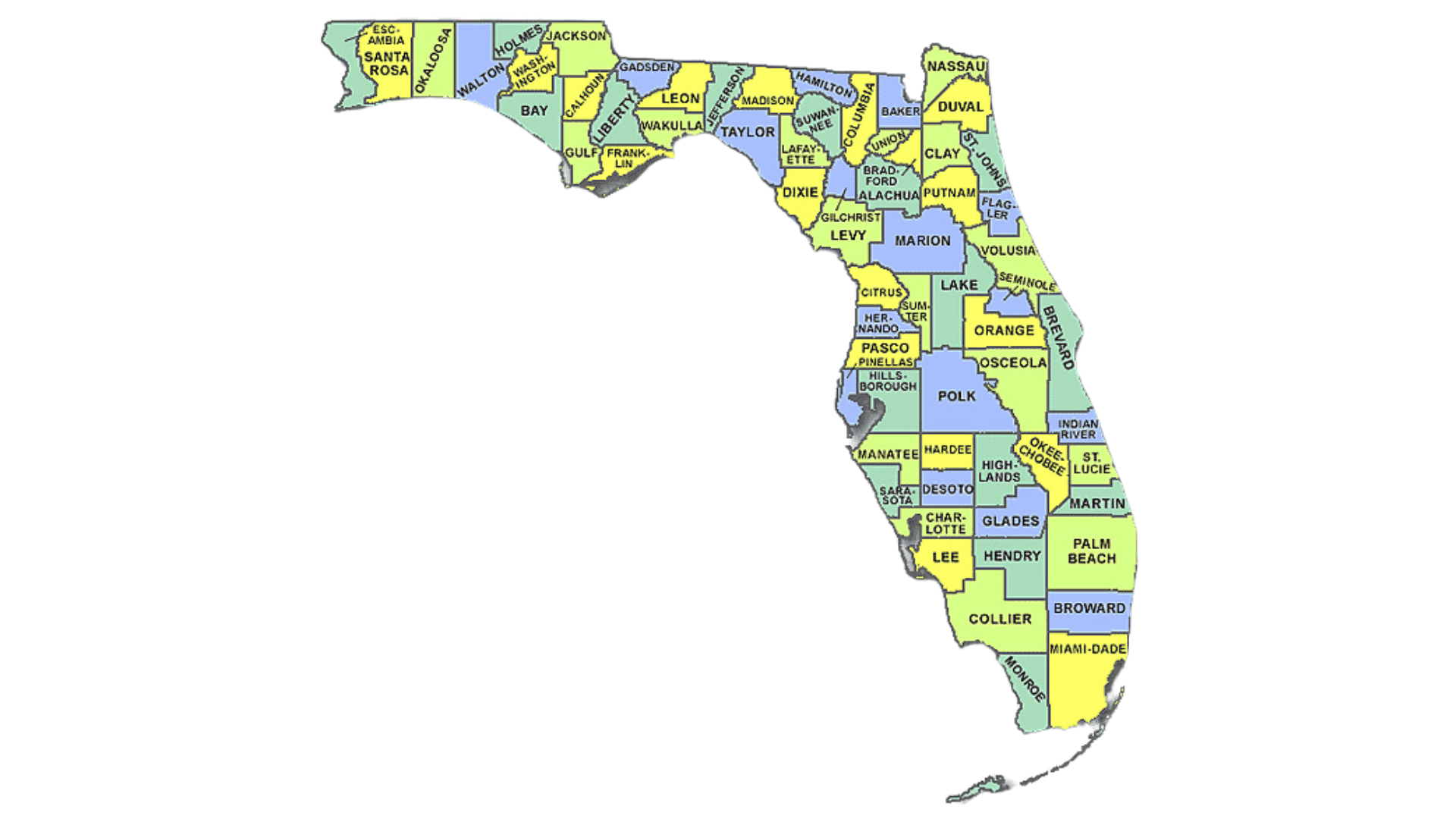

4. Pick the Right Location

Florida has so many great places to live, but you need to find the one that’s perfect for you. Think about:

-

Jobs: Are you close to work or job opportunities? Cities like Miami, Tampa, and Jacksonville have lots of jobs, but suburban areas might be more affordable.

-

Schools: If you have kids or plan to, check out the local school districts. GreatSchools.org is a good resource for ratings and reviews.

-

Lifestyle: Do you want to live near the beach, in a busy city, or in a quiet neighborhood? Florida has it all!

-

Future Growth: Look for areas with new developments, like shopping centers or parks. These areas often grow in value over time.

Choosing the right location is just as important as choosing the right home. Take your time and visit different neighborhoods to see what feels like home to you.

Not sure where to start? Bernard Jackson can help you find the perfect neighborhood. Call 321.443.5582 or visit www.bernardsellsflhomes.com today!

5. New Construction vs. Existing Homes

In 2025, you’ll have two main options: new construction homes or existing homes. Here’s what to consider:

-

New Construction: These homes are brand new, so you can often customize them to fit your style. They also come with modern features like energy-efficient appliances and smart home technology. However, they can take longer to build and might cost more.

-

Existing Homes: These homes are already built, so you can move in faster. They’re often in established neighborhoods with mature trees and parks. However, they might need repairs or updates.

Think about what’s most important to you. Do you want a move-in-ready home, or are you willing to wait for a custom build?

Let Bernard Jackson guide you through the pros and cons of each option. Call 321.443.5582 or visit www.bernardsellsflhomes.com to get started.

6. Think About Climate Resilience

Florida’s weather can be tough, so it’s important to choose a home that can handle it. Look for:

-

Flood Zones: Check FEMA flood maps to see if the home is in a flood-prone area. If it is, you’ll need flood insurance.

-

Hurricane Protection: Look for homes with impact-resistant windows, reinforced roofs, and storm shutters. These features can save you money on insurance and keep your family safe.

-

Energy Efficiency: Homes with solar panels, energy-efficient appliances, and good insulation can save you money on utilities.

Climate resilience isn’t just about safety—it’s also about saving money in the long run.

Need help finding a climate-resilient home? Contact Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com for expert advice.

7. Work with a Local REALTOR®

A good REALTOR® can make the homebuying process much easier. They can:

-

Help You Find Homes: They know the market and can show you homes that fit your budget and needs.

-

Negotiate for You: They’ll work to get you the best price and terms.

-

Guide You Through the Process: From making an offer to closing, they’ll be there every step of the way.

If you’re looking for a Florida REALTOR®, make sure to choose someone with experience and good reviews. Bernard Jackson at LPT Realty is here to help you every step of the way.

Call Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com to start your homebuying journey today!

8. Don’t Skip the Home Inspection

A home inspection is a must, even if the home looks perfect. The inspector will check for:

-

Structural Problems: Like cracks in the foundation or roof damage.

-

System Issues: Such as old plumbing, electrical problems, or a broken HVAC system.

-

Safety Hazards: Like mold, asbestos, or pests.

In Florida, it’s also a good idea to get a wind mitigation inspection and a flood risk assessment. These can save you money on insurance and give you peace of mind.

Bernard Jackson can recommend trusted home inspectors to ensure your future home is in great condition. Call 321.443.5582 or visit www.bernardsellsflhomes.com to learn more.

9. Plan for Long-Term Costs

Owning a home comes with ongoing expenses. Be ready for:

-

Property Taxes: Florida doesn’t have a state income tax, but property taxes can be high.

-

Insurance: Homeowners insurance and flood insurance are a must in Florida.

-

Maintenance: Things like lawn care, repairs, and HOA fees can add up.

-

Utilities: Don’t forget to budget for water, electricity, and internet.

Planning for these costs will help you avoid surprises and stay on budget.

Bernard Jackson can help you create a budget that works for you. Call 321.443.5582 or visit www.bernardsellsflhomes.com to get started.

10. Embrace Technology

Technology is changing the way we buy homes. In 2025, you can expect:

-

Virtual Tours: Many homes will have 3D tours online, so you can explore them from your couch.

-

Smart Homes: Look for homes with smart thermostats, security systems, and energy-saving features.

-

Online Closings: Some lenders are using blockchain technology to make closings faster and more secure.

Using technology can make the homebuying process easier and more fun.

Ready to explore homes online? Bernard Jackson can help you navigate the latest tech tools. Call 321.443.5582 or visit www.bernardsellsflhomes.com today!

Final Thoughts

Becoming a homeowner in 2025 is an exciting goal, and with the right preparation, you can make it happen. Start by learning about the market, getting your finances in order, and working with a trusted REALTOR®. Florida’s diverse housing market has something for everyone, whether you’re looking for a beachfront condo, a suburban family home, or a quiet retreat.

If you’re ready to take the next step, reach out to Bernard Jackson at LPT Realty today. With years of experience and a passion for helping buyers like you, Bernard will guide you through every step of the process.

Call Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com to start your journey to homeownership today!

About the Bernard Jackson

Bernard Jackson is a dedicated and highly regarded REALTOR® serving the Central Florida real estate market. With a strong presence in Kissimmee, Davenport, Winter Haven, and Haines City, Bernard is known for his deep market knowledge, strong negotiation skills, and unwavering commitment to his clients.

Clients consistently praise Bernard for his attentiveness, responsiveness, and ability to secure the best deals—whether they’re buying their first home, upgrading, or selling a property. His personalized approach ensures that every client’s unique needs and goals are met with expert guidance and care.

Bernard's reputation is built on trust, professionalism, and a results-driven mindset, making him a top choice for homebuyers and sellers in the area. His 5-star reviews highlight his ability to navigate the complexities of real estate with ease, providing a smooth and stress-free experience.

To learn more about Bernard Jackson and read client testimonials, visit:

📍 Google Business Profile – Search "Bernard Jackson Realtor"

📍 Realtor.com – Find client reviews and real estate insights

📍 LinkedIn – Connect with Bernard for additional insights

For expert real estate guidance, contact Bernard Jackson at 321.443.5582 or visit www.bernardsellsflhomes.com/contact

Categories

- All Blogs (131)

- #FearlessFriday (10)

- #MotivationalMonday (14)

- #solutionsaturday (6)

- #SoulfulSunday (7)

- #TechnologyThursday (10)

- #WellnessWednesday (14)

- 10 Steps To Know About Buying A Home In Poinciana (1)

- 10 Things To Know About Davenport (1)

- 10 Things To Know About Poinciana (1)

- 5 New Things For Poinciana For 2025 (1)

- Annual Events and Festivals in Kissimmee, Fl (1)

- Benefits of Living in Poinciana (1)

- Benefits of Selling to a Cash Buyer (1)

- Buyers (34)

- Kissimmee Homes For Rent (2)

- Kissimmee Homes For Sale (7)

- Pros and Cons of Living in Kissimmee, FL (1)

- Renters (12)

- Retirement In Poinciana, FL (1)

- Sellers (7)

- Things To Do In Poinciana (2)

- Things To Do Near Kissimmee, FL (2)

- Things To Do NYE 2025 In Orlando and Kissimmee, FL (1)

- Truth About 20 Percent Down (1)

- What Are The Benefits of Living In Kissimmee (1)

- Your Dream House (1)

Recent Posts

GET MORE INFORMATION